Investing provides you the ability to build wealth, securing your financial freedom into the future. At Finlinx Wealth, we construct investments that aim to achieve desired outcomes while developing our clients knowledge and understanding along the journey.

“When you Invest you are buying a day that you don’t have to work”

– Aya Laraya

Key To Investing

For many the basis for investing is to make money – not to say that we don’t all want to make money and build wealth, but why?

It’s important to understand the why you want to invest before you start the journey. Is it to provide for your families future, achieve passive income to allow you to reduce work, buy that holiday home, retire early or comfortably.

Once you understand the why, investing has meaning – with a why you are more likely to succeed as there is purpose to the act of investing.

The investment approach that Finlinx Wealth takes to achieve our clients why can be read about here – Investment Principles

Some Of The Keys To Our Approach Are:

– Time in the market, not timing the market

Speculators will often try to ‘time the market’ in an effort to buy shares at what they consider to be a low point, and (hopefully) sell them quickly at a higher price. This is a high-risk, guess-based strategy that can lead to big wins, and big losses.

Conversely, we take the evidence-based approach that the market has generally trended upwards over the last 100 years, and (over significant periods of time) has delivered solid returns for investors. While there are fluctuations in share prices between days, weeks, and even years – we can reasonably expect the value of quality shares to increase over time. i.e. if you spend enough time in the market, you’ll see positive returns. And we have.

Below is a chart of the value of the ASX 200 Index (made up of the top 200 companies listed on AU Stock Exchange) from 1993 to 2020.

Diversification

If you invest in one company, you are putting all your investment eggs in one basket. Your fortunes are inextricably linked to that one company’s performance. Even if you invest in ten great Australian companies, you can still be exposed to the ups and downs of the Australian economy. The same applies when you invest in just a handful of industries.

We have highly diversified portfolios that include quality shares across many countries, industries, and companies.

This means that you are well placed to weather any localised ‘storms’.

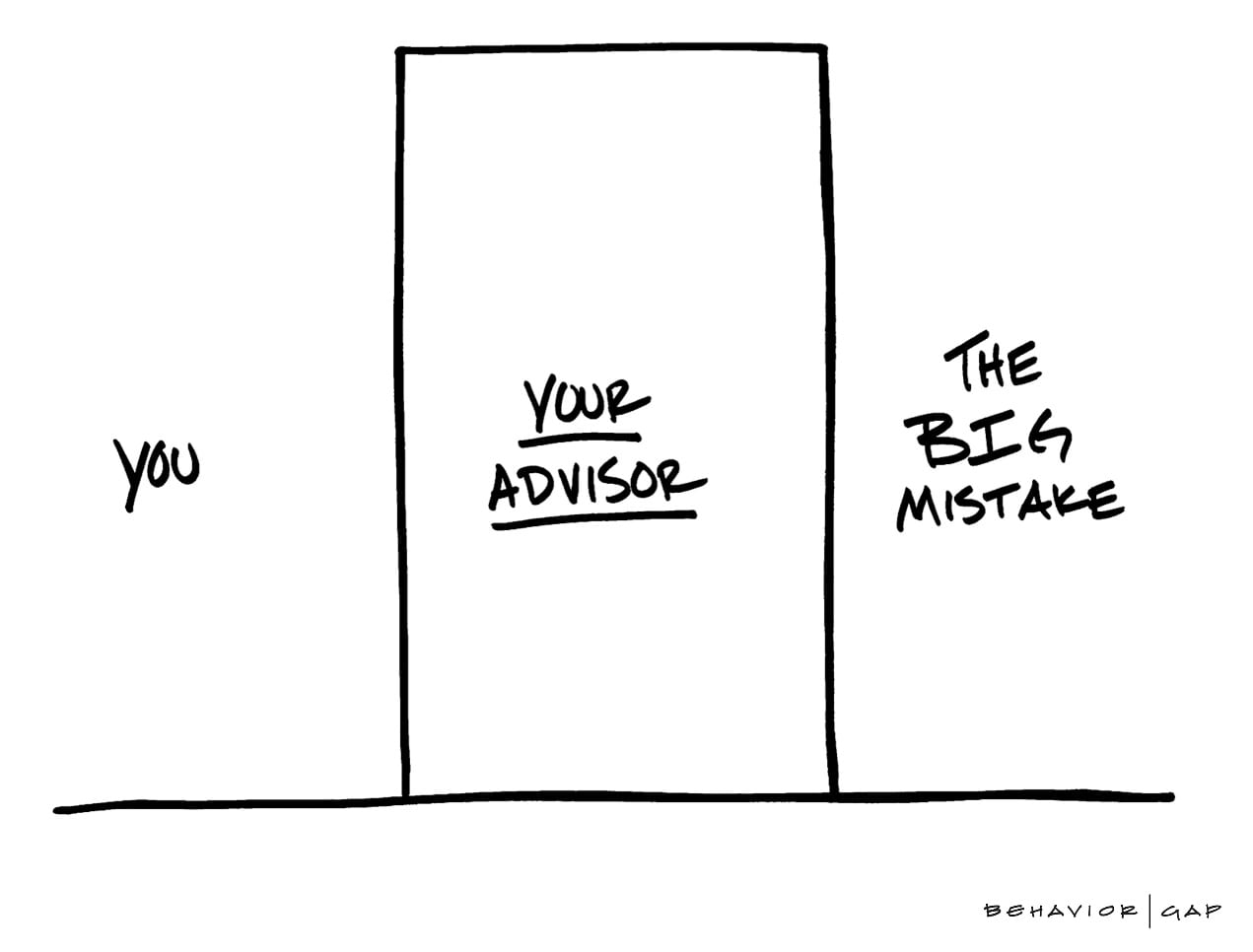

Managing Emotional Reactions

Overcoming emotions is a fundamental part of success in investing. It is very easy to get nervous when our share performance dips, or get overly excited when things are going well. However, reacting emotionally to short-term fluctuations in prices – rather than sticking to a measured, long-term strategy – can be very costly.

At Finlinx Wealth, our highly experienced advisers work with clients to ensure they understand that riding the wave of emotions through investment cycles is part of the recipe for financial success or happiness. We build solid, best-practice investment strategies, and rely on them to deliver the desired outcomes.

Ready To Find Out More?

If you’d like to discover more about investing with Finlinx Wealth, please Schedule A Call or get in touch via email. One of our advisers will answer any questions you have, and (if you wish to proceed) look to set up a no-obligation initial discovery meeting to get your options.

We look forward to hearing from you.