Finlinx Wealth offers a highly personalised and holistic approach to financial planning, investing, and wealth management. We work to understand your values and goals – as well as the level of risk you are comfortable with.

Everyone’s situation is unique, and your investment strategy will always reflect your personal objectives and timelines.

Your financial adviser works with you to develop a portfolio that best fits your circumstances. This might be a ‘growth’ focused portfolio that aims for higher returns over a longer time period. Alternatively, it might be a ‘defensive’ focused portfolio for those looking for more reliable, low risk income in the short term.

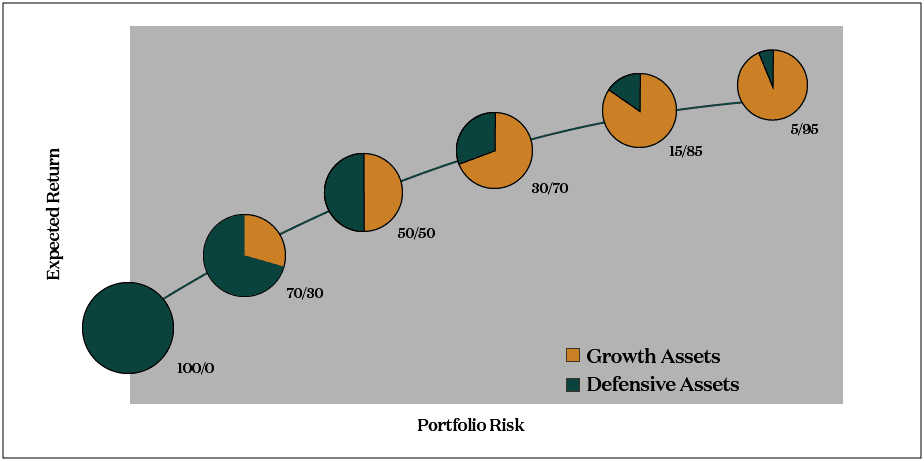

Generally, you’ll have a strategic ratio of both growth and defensive assets, as the examples below represent:

Your adviser will help you make the best decision on what asset mix your portfolio should contain. You have full visibility of your portfolio via an online portal and regular adviser updates.

Portfolio Risk/Return Relationship

In our view the major financial markets are very efficient; knowledge and information about markets flows freely to all participants. As a result, it is essential to understand that greater investment risk is necessary in order to achieve higher returns. There is no sustainable high return, low risk investment.

Each of our portfolios is tailored to suit our clients risk tolerances and investment objectives. The risk/return relationship between defensive and growth assets is illustrated below: